Banking stocks are often seen as the backbone of any long-term portfolio, but real success comes from blending sharp technical analysis with solid fundamentals. In this blog, I’ll walk you through my real-life journey of turning a ₹1.8 lakh investment in AU Small Finance Bank into a ₹72,000 profit in 7 months. I’ll break down my technical setup, risk-reward calculation, phased buying strategy, and the fundamental reasons that gave me the conviction to hold for big gains.

📈 The Technical Setup: Spotting the Opportunity

Back in November 2024, I was closely tracking the weekly charts of AU Small Finance Bank. The stock was trading at around ₹580, and what stood out to me was its clear, multi-year range-bound structure:

- Range-Bound Structure: For several years, the stock had oscillated between ₹480–500 (support) and ₹800–820 (resistance).

- Defined Risk-Reward:

- Potential Risk: My entry price was ₹580, with a logical stop-loss at ₹500 (the lower support). That’s a downside of ₹80 per share or about 14%.

- Potential Reward: My target was ₹820 (the upper resistance), giving an upside of ₹240 per share or about 41%.

- Risk-Reward Ratio:

- Potential Risk: My entry price was ₹580, with a logical stop-loss at ₹500 (the lower support). That’s a downside of ₹80 per share or about 14%.

This means for every ₹1 at risk, I stood to gain ₹3—a classic, high-conviction setup.

Long-Term Weekly View: Since I was analyzing the weekly chart, I knew this would be a long-term play, not a quick trade.

Why AU Small Finance Bank?

Technical analysis gave me the “when,” but fundamentals gave me the “why.” Here’s why I chose AU SFB for this investment:

- Consistent Growth: AU SFB has shown strong growth in advances and deposits, especially in the retail and MSME segments.

- Superior Asset Quality: The bank’s Gross and Net NPAs have consistently improved, reflecting prudent risk management.

- Valuation Comfort: Even with a premium P/B ratio, AU SFB’s steady ROE and NIM justified its valuation.

- Sector Tailwinds: The bank benefits from India’s push for financial inclusion, digital banking, and rural expansion.

- Management Quality: Strong leadership and governance further boosted my confidence.

For a detailed breakdown of AU SFB’s strengths and sector comparison, check out my deep-dive: AU Small Finance Bank: A Comparative Fundamental Analysis

💸 My Investment Strategy: Phased Allocation

I never go all-in at once. Here’s how I built my position in AU SFB:

- Initial Entry (Nov 2024, ₹580): Invested 35% of my capital as the stock neared the lower end of its range.

- First Add (Jan 2025 End): Added another 35% as the stock started reversing(Although I was wrong).

- Final Add (Feb 2025): Deployed the remaining 30% as the stock held support and started reversing.

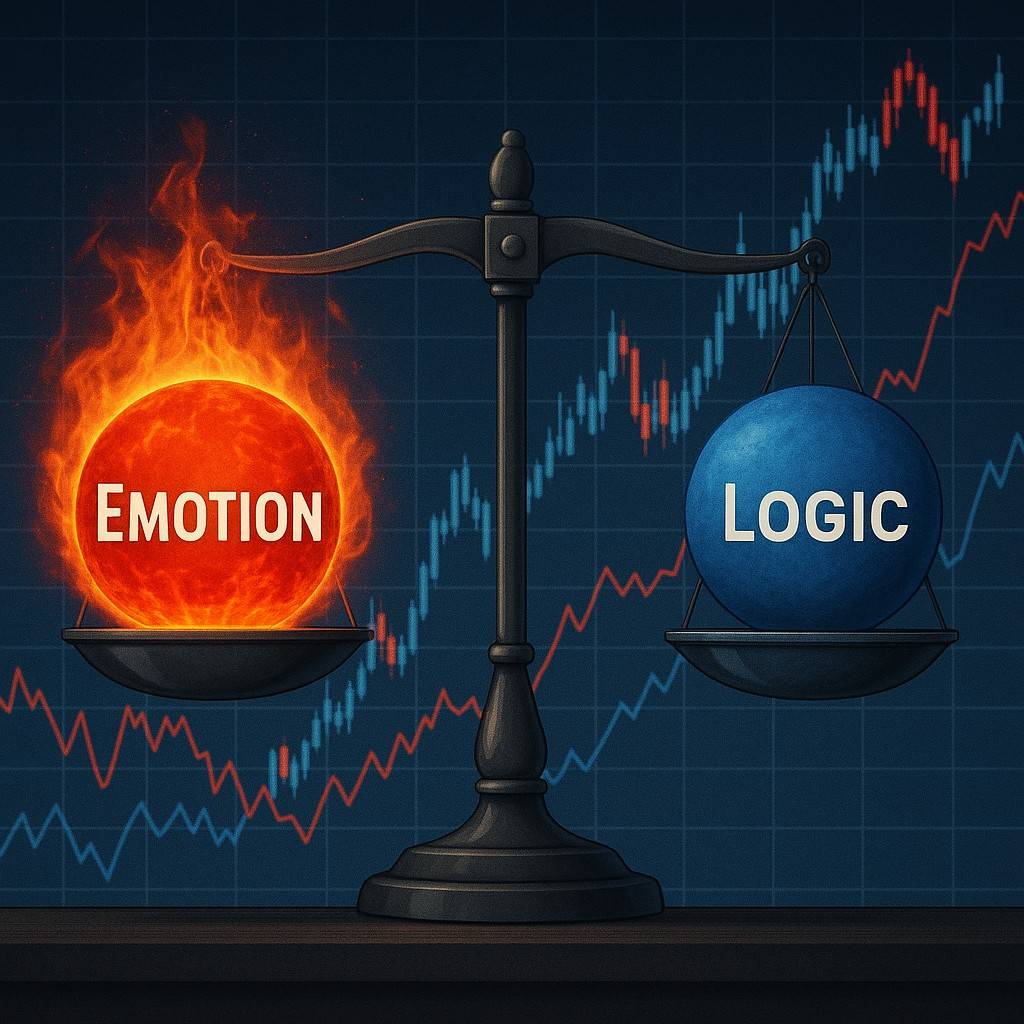

This phased approach helped me manage risk, avoid emotional decisions, and average into a high-conviction trade.

🚀 The Payoff: 40% Gains, ₹72,000 Profit

Fast forward to July 2025: AU SFB is trading at ₹819.50. My average buy price is around ₹585, and I’m sitting on a 40% gain—a profit of ₹72,000 on my ₹1.8 lakh investment.

Below is the profit screenshot attached of my position:

🔍 Technical Analysis Review

- Breakout Confirmation: The recent surge past the ₹800–820 resistance signals a new uptrend, backed by strong volume and momentum.

- Support Holds: The ₹480–500 zone repeatedly acted as a floor, confirming the range’s reliability.

Long-Term Structure: Weekly consolidation followed by a breakout is a textbook recipe for sustained moves.

📝 Key Takeaways for Investors

- Blend Technicals with Fundamentals: Use charts for timing, but let business quality drive conviction.

- Define Your Risk: Always know your stop-loss and target before entering.

- Phased Buying Works: Averaging in reduces regret and manages volatility.

Be Patient: Weekly setups are for long-term thinkers, not day traders.

Ready to level up your banking sector investing?

Check out my deep-dive: AU Small Finance Bank: A Comparative Fundamental Analysis

Disclaimer: This post is for educational purposes only. Investing in equities involves risk. Do your own research or consult a financial advisor before investing.

If you enjoyed this post, share it with your investing friends and subscribe for more real-world trading stories and actionable insights!